To clear away some of the fog that surrounds the tangled issue of property taxes in Italy and what you have to pay for this coming 2017, here is your ultimate Italy property tax guide.

Three important things to remember

1) Primary home, goodbye TASI and IMU – Abolition of TASI and IMU taxes for principal homes. Luxury homes are, however, excluded from this benefit. ‘Luxury homes’ are all those properties belonging to the following categories: A/1 (stately homes), A/8 (villas), A/9 (castles and palazzi with high artistic and historic value).

2) Discount for landlords – Home owners who rent out their homes with an “agreed rental” contract (canone concordato) will receive a 75% discount on the rates upon which IMU and TASI taxes are calculated. The ‘agreed rental contract’ is a contract with a minimum duration of 3 years plus 2 (or 3) years of renewal for residential properties; from 6 months to 3 years for university students and from 1 to 18 months for brief contracts.

3) Agricultural and building land – There is a differentiation between agricultural land and building area with the first benefitting from an exemption from IMU and TASI.

What will it cost to buy and maintain your home in Italy?

Whether Italian resident or not, here are the property taxes you must pay in Italy in 2017:

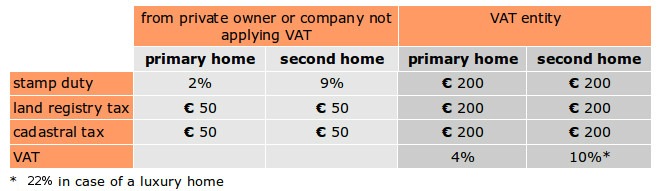

1) Taxes on the purchase of a property in Italy – Stamp duty (imposta di registro), land registry (imposta ipotecaria), cadastral (imposta catastale) and VAT taxes plus other minor taxes.

The “cadastral declared value” of the property on the Rogito (deed of sale) represents the basis (base imponibile) upon which the first three taxes we have just mentioned are applied, whereas VAT is applied on the purchase price and it is due only in case you buy your house from an entity applying VAT – it must be written also in the deed of purchase or in the preliminary contract – or from a developer or a property renovation company within 5 years from the end of the works.

It is important to remember that at the moment the cadastral value of a property is still much lower than the market price, as the latest appraisals go back to many years ago.

– If you purchase a principal home (prima casa) in Italy – in case you take out residency at your acquired property within 18 months from the final contract signing, and spend more than 6 months a year at that address – from a private seller or a company not applying VAT, the stamp duty is equal to 2% of the value (with € 1,000 as the minimum payment due); land registry and cadastral taxes are fixed at € 50 each.

Be careful! You will pay a little more if you buy your ideal house from a company applying VAT. In this case, VAT is stable at 4% of the declared property price, and the other previously mentioned levies are equal to € 200 each.

– If you are buying a property in Italy as your second home, you must pay a stamp duty which is equal to 9% (with € 1,000 as the minimum payment due); a land registry and a cadastral tax are fixed at € 50 each. You must pay also VAT in case you buy from a company applying VAT, which is stable at 10% of the declared property price, and you will have to pay € 200 for each of the other three levies.

2) After the purchase, home owners are subject to taxes on the ownership of the property in Italy, namely IUC (Imposta Municipale Unica) that includes IMU and TASI, and TARI:

– IMU (tax on the ownership of the property): in 2017 owners of primary homes are relieved from IMU unless they don’t own a luxury home (A/1, A/8, A/9 categories). But if you own a second home then you must pay IMU. It is applied on the cadastral value of the property plus a 5% that you have to multiply for a coefficient that may vary from town to town.

– TASI: it involves services provided by the Town Hall in which the property is situated, such as taxes on street lighting and maintenance, etc. In 2017 primary homes are relieved from TASI unless you own a luxury home. Also in this case TASI calculation may vary from town to town.

TASI doesn’t exist in the autonomous provinces of Trento and Bolzano, where it replaced by IMI and IMIS.

– TARI: it involves taxes on waste collection and its payment includes a fixed rate based on square meters plus a variable rate based on the number of people belonging to the family living in that place.

Tax on renting out your Italian real estate

The tenant have to pay for TARI and a portion of the TASI. In case one rents your property for more than 6 months in the same solar here but he has no residency in your property, he will pay between 10% and 30% of the total TASI amount, and you will pay for the rest. Otherwise, if it represents his main residence then you are the only one entitled to pay, and you will have to pay for a 90% or a percentage decided by the Town Hall in which the property is situated.

Tax on selling your home in Italy

In the peninsula no capital gain tax is due if the property you sell was purchase more than 5 year prior to the sale.

>> In any case we strongly recommend you to check carefully the taxes you have to pay and their exact amount with the help of an expert.

[This an updated article. Last updated on 20 December 2016]